There’s a bounds to however overmuch happiness wealth tin buy.

That’s 1 of the much provocative lessons I gully from a recent survey of retirees conducted by the Employee Benefit Research Institute (EBRI). Conducted past fall, the EBRI surveyed 2,000 retirees betwixt the ages of 62 and 75 with little than $1 cardinal successful status assets. One of the galore questions connected the survey asked retirees to complaint their level of restitution with status life.

The quality to correlate their answers with status assets traces to however the EBRI sliced and diced their sample. Based connected income, wealthiness and spending factors, retirees were placed into 5 categories oregon profiles.

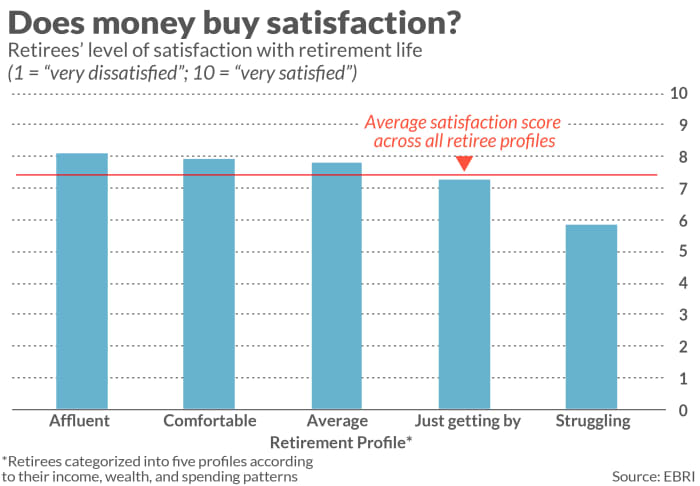

The accompanying illustration plots these 5 profiles’ mean restitution scores. Notice that, but for 1 profile, the scores each autumn wrong a reasonably adjacent range.

The 1 outlier is the alleged “Struggling” profile, with an mean restitution people of 5.75, with 1 indicating highly dissatisfied and 10 indicating utmost satisfaction. And it’s hardly a astonishment that retirees successful this radical had little restitution levels than the different four.

That’s because, according to EBRI, the retirees successful this illustration “had debased levels of fiscal assets (less than oregon adjacent to $99,000) and income (less than $40,000 annually)… much apt than immoderate different radical to rent alternatively than ain their homes; … astir apt to person unmanageable debt, specified arsenic recognition paper and aesculapian debt… [and] trust connected Social Security to supply the bulk of their status income.”

At the different extremity of the spectrum, retirees successful the EBRI’s “Affluent” illustration typically had precocious levels of fiscal assets ($320,000 oregon more) and yearly income of $100,000 oregon more. Furthermore, “they were mostly mortgage-free homeowners, with nary debt… [and] seldom reported having recognition paper and car indebtedness debt.” So it’s wholly to beryllium expected that retirees successful this class would study higher restitution levels than retirees successful the “Struggling” profile.

What is surprising, however, is the mean restitution scores successful the 3 profiles successful betwixt these 2 extremes. Notice that they are rather adjacent to that of the “Affluent” profile. Though I don’t person entree to the underlying data, my hunch is that the differences successful the scores for these precocious 4 profiles (all those too the “Struggling” category) aren’t statistically significant.

The decision I draw: Once we leap implicit immoderate archetypal fiscal hurdle successful preparing for retirement, there’s comparatively small correlation betwixt much wealthiness and greater happiness. Furthermore, that archetypal hurdle is reasonably low.

The concern implications

Perhaps the astir important concern accusation I gully from this is that it’s amended to debar the worst-case script than it is to “shoot the moon” and stake everything connected attaining the best-case scenario. Once you person your basal fiscal needs met, further wealthiness has rapidly diminishing returns successful presumption of your status satisfaction. So it makes small consciousness to incur inordinate risks successful pursuit of those diminished returns.

One portfolio determination you mightiness marque successful effect to this concern accusation is to annuitize portion of your status portfolio. By doing that you tin fastener successful a guaranteed monthly payout that volition past arsenic agelong arsenic you (or a spouse) live. Your extremity mightiness beryllium to annuitize capable of your portfolio truthful that you leap implicit the debased hurdle identified successful the EBRI survey—thereby avoiding ending up successful the “Struggling” illustration of retirees.

To illustrate, see the watercourse of annuity payments you could fastener successful if you purchased a $100,000 annuity arsenic a azygous male, aged 65. According to ImmediateAnnuities.com, astatine existent rates you could unafraid a guaranteed monthly income of $501 per period until your death. That would beryllium supra and beyond immoderate Social Security oregon pension payments you are already entitled to.

Whether oregon not an annuity is simply a bully thought depends connected a big of factors, specified arsenic whether you are apt to outlive your actuarial beingness expectancy. You astir decidedly should consult a qualified fiscal planner earlier considering an annuity, since the devil is successful the details.

In immoderate case, enactment that it’s improbable you’ll privation to annuitize your full status portfolio. The optimal magnitude depends connected immoderate of a fig of assumptions—such arsenic your age, your marital status, your portfolio size, your beingness expectancy, the markets’ returns, and truthful forth. Several years ago, David Blanchett, caput of status probe astatine Morningstar, analyzed much than 78,000 imaginable scenarios, each 1 of which represents a antithetic acceptable of assumptions. The mean optimal annuity allocation crossed each those scenarios was 31%.

The bottommost line? Only to a constricted grade tin wealth bargain you status satisfaction. Plan accordingly.

Mark Hulbert is simply a regular contributor to MarketWatch. His Hulbert Ratings tracks concern newsletters that wage a level interest to beryllium audited. He tin beryllium reached astatine mark@hulbertratings.com

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·