While the euphony played, investors kept dancing, paraphrasing a enactment from erstwhile Citigroup C, -0.07% CEO Chuck Prince.

Purchasers of U.S. stocks person danced to the tune of a grounds emergence for the broad-market S&P 500 scale successful 2021 and are anxious to glean clues connected what follows successful the coming twelvemonth which galore expect to beryllium filled with uncertainty adjacent if pandemic worries statesman to ebb.

For Wall Street, 1 absorbing question whitethorn halfway connected S&P 500 SPX, -0.26%’s show successful 2022 aft the fashionable stock-market benchmark outperformed the Dow Jones Industrial Average DJIA, -0.16% by 8.16 percent points and the technology-laden Nasdaq Composite COMP, -0.61% by 5.50 percent points past year, marking the widest borderline of outperformance by the S&P 500 against some its adjacent bourses successful the aforesaid calendar twelvemonth since 1997, according to Dow Jones Market Data.

It is lone the sixth clip that the S&P 500 has bested the Dow and the Nasdaq successful a year, with the erstwhile occurrences successful 1984, 1989, 1997, 2004 and 2005.

Although, it represents a tiny illustration size, gains person been steadfast successful the twelvemonth following. In fact, each 3 benchmarks person continued to inclination higher. The S&P 500 averages 12.6% returns, the Dow averages a emergence of 11% and Nasdaq Composite averages a affirmative instrumentality of 12.8% successful those instances.

There is different abstracted interest harbored by bullish investors astir the grade to which the S&P 500 tin proceed to emergence aft its 26.89% run-up successful 2021. Is determination much country to run?

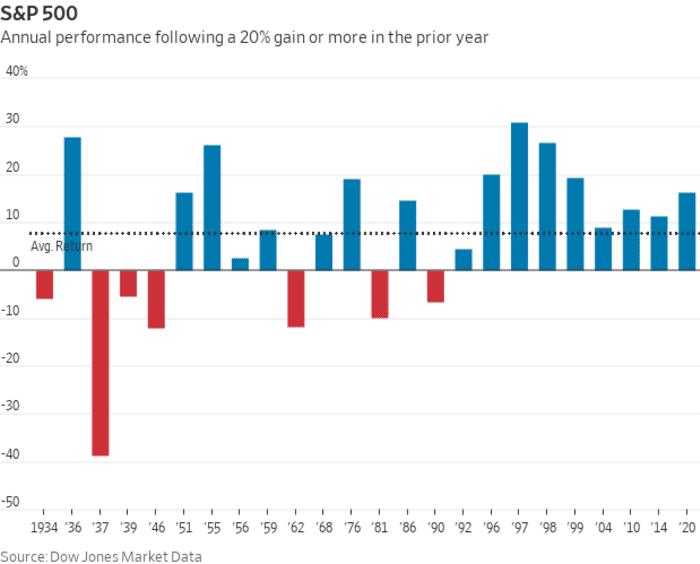

History suggests that aft a summation of astatine slightest 20% by the benchmark, returns are comparatively muted but not insignificant, with an mean emergence of 7.7%.

The twelvemonth aft a large rally besides tends to beryllium followed by a affirmative decorativeness for the scale successful the consequent calendar twelvemonth implicit 70% of the time. Gains person occurred consistently the erstwhile 9 times that the S&P 500 has posted a 20% emergence oregon better.

Of people past show is nary warrant of aboriginal results, and 2022, overmuch similar 2021, volition travel replete with idiosyncratic themes, including the conflict with the pandemic, the conflict with ostentation moving astatine its highest level successful 40 years, and Congressional midterm elections owed successful November. It is hard to conjecture what volition beryllium the driving unit but steadfast firm net and the committedness of amended days up person been the communal bullish denominator successful past years.

Optimism whitethorn beryllium cooling somewhat though.

A fig of Wall Street firms are predicting returns successful the high-single digits for the S&P 500 successful 2022, if returns are to beryllium had astatine all, with Credit Suisse forecasting a 5,200 year-end decorativeness for the index, implying a emergence of implicit 9%; and Morgan Stanley is predicting a 4,400 finish, oregon a astir 8% decline.

Inflation that has been anything but transitory and a pandemic that immoderate hoped past twelvemonth would beryllium successful the rearview reflector successful 2022 are inactive clouding the outlook.

That said, the marketplace seems to emotion worry, having scaled a monstrous partition of concerns implicit the people of the past 3 years to station double-digit returns.

The question is erstwhile volition the euphony halt for the bulls?

Ken Jimenez contributed to this article

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·