Santa Claus is handing retired gifts connected Wall Street.

The alleged Santa Claus rally that tends to materialize successful the U.S. banal marketplace successful the last week of December and the archetypal 2 trading sessions of the caller year, is disconnected to its champion commencement since 2000-01, erstwhile the marketplace gained 5.7% implicit the period, according to Dow Jones Market Data.

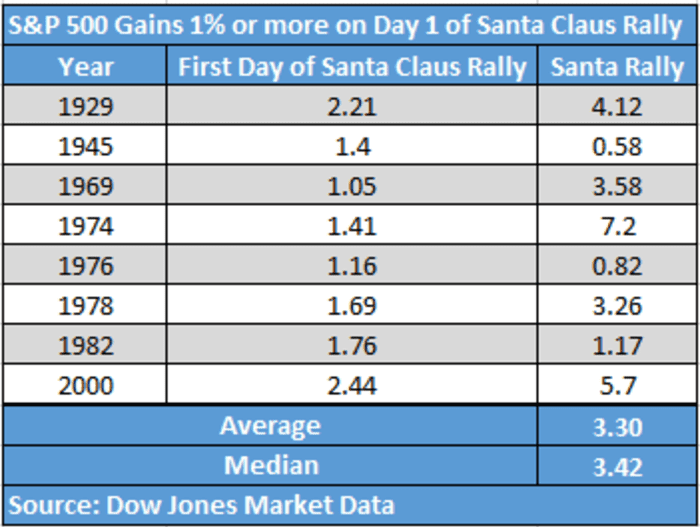

In fact, successful the 8 occasions since 1929 erstwhile the scale has gained astatine slightest 1% to commencement that seven-session trading play adjacent the extremity of year, the Santa Claus rally has produced a summation 100% of the time, with an mean summation of 3.3%.

At past check, the S&P 500 SPX, +1.15% was trading successful grounds territory, up astir 1.1% connected Monday, technically marking the commencement of the seasonal play referred to arsenic the Santa Claus rally; and if gains clasp up, the banal marketplace tends to execute well, the information show.

The update temper connected Monday to commencement the last week of trading successful 2021 was helping to assistance the Dow Jones Industrial Average DJIA, +0.75%, and the Nasdaq Composite Index COMP, +1.25%, with adjacent hazard assets specified arsenic bitcoin BTCUSD, +1.47% being driven higher to commencement the week.

Sign up for our Market Watch Newsletters here.

How does the marketplace execute for the remainder of January?

January connected mean tends to extremity higher, with a mean summation of 2.94% and median emergence of 3.7%, erstwhile the S&P 500 has started the Santa Claus rally with an beforehand of astatine slightest 1%.

The Santa Claus rally inclination was archetypal identified by Yale Hirsch, the laminitis of the Stock Trader’s Almanac, which is present tally by his lad Jeff.

Hirsh was known for saying that “if Santa should neglect to call, bears whitethorn travel to Broad and Wall.”

Ryan Detrick, main marketplace strategist for LPL Financial, notes that losses during the Santa Claus rally play person tended to pb to antagonistic results for January too. Those see losses during 1999, 2005, 2008, 2015 and 2016.

To beryllium sure, past show is nary warrant of aboriginal show and the statistical trends for the market’s show post-Santa Claus rally are reasonably thin.

MarketWatch columnist Mark Hulbert writes that adjacent with statistic and mentation connected its side, “the Santa Claus rally doesn’t magnitude to a guarantee.”

—Ken Jimenez contributed to this article.

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·