U.S. location prices person been rising astatine a grounds yearly pace successful caller months, fueled successful portion by historically cheap credit, the lack of properties for sale, and the scramble by households for much abstraction arsenic families person fled to the suburbs during the pandemic.

Can the bully times past erstwhile the Federal Reserve yet cuts backmost connected buying owe and Treasury bonds? Here’s however owe rates and a little gargantuan cardinal slope footprint could interaction the heated U.S. lodging market.

“The Fed is surely talking and reasoning astir it,” said Kathy Jones, main fixed income strategist astatine the Schwab Center for Financial Research, connected the taxable of however the Federal Reserve could standard backmost the cardinal bank’s $120 cardinal a period bond-buying program.

But Jones besides thinks tighter recognition conditions, apt via higher borrowing rates arsenic the Fed tapers its enslaved buying program, mightiness extremity up being a redeeming grace for today’s lodging market.

“Housing prices could surely propulsion back, aft accelerating truthful fast,” she said, pointing to households warring implicit the fewer properties disposable to buy, portion navigating enactment from home. “At immoderate point,” she said, owe payments connected high-priced homes “become unsustainable with people’s incomes.”

“But I don’t spot a large lodging debacle.”

How to pump the brakes connected housing

The cardinal slope has maintained a ample footprint successful the owe marketplace for much than a decade, but the worsening affordability situation successful the U.S. lodging marketplace led Fed officials to locomotion a tightrope precocious erstwhile trying to explicate its ongoing large-scale plus purchases during the pandemic recovery.

Fed officials successful caller weeks person expressed a just spot of disagreement astir the timing and gait of immoderate scaling backmost of its large-scale plus purchases.

St. Louis Fed President James Bullard said Friday the cardinal slope should commencement to dilatory down its enslaved purchases this autumn and decorativeness by March, saying helium thought fiscal markets “are precise good prepared” for the simplification successful purchases.

During a midweek property briefing, Chairman Jerome Powell said tapering apt would commencement with bureau mortgage-backed securities (MBS) and Treasury bonds astatine the aforesaid time, but besides “the thought of reducing” owe vulnerability “at a somewhat faster gait does person immoderate traction with immoderate people”.

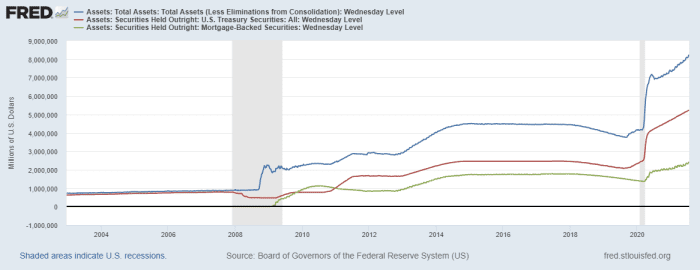

The bluish enactment successful the illustration beneath traces the cardinal bank’s balance sheet and abrupt way to a $8.2 trillion equilibrium expanse since 2020 erstwhile its efforts to enactment markets during the pandemic began, with the reddish enactment representing its Treasury TMUBMUSD10Y, 1.228% holdings and greenish enactment its MBS. MBB, +0.02%

Fed holds large cards successful MBS and Treasury markets

St. Louis Fed dataAs of July 29, the Fed was holding about 31% of the astir $7.8 trillion bureau MBS market, oregon lodging bonds with authorities backing.

“You could marque the lawsuit that the Fed owns astir one-third of the bureau owe enslaved market, and that it mightiness marque consciousness to loosen its grip,” Jones said, peculiarly arsenic Powell has played down a nonstop link betwixt its MBS purchases and climbing location prices.

It whitethorn present look similar a distant memory, but earlier the pandemic upheaval, that was precisely what the Fed was trying to do.

“Who would person thought,” said Paul Jablansky, caput of fixed income astatine Guardian Life Insurance, that the U.S. would beryllium successful the midst of “one of the frothiest lodging markets successful history,” pursuing past year’s utmost pandemic shutdowns that closed businesses, workplaces and nationalist borders.

“Occasionally radical ask, are we astatine the peak?” said Jablansky, a 30-year seasoned of the mortgage, and asset-backed and broader enslaved market. “We are extracurricular the equilibrium of our experience, truthful it’s precise hard to accidental we are astatine the peak,” helium told MarketWatch.

“I bash deliberation location terms ostentation volition person to dilatory down dramatically. But possibly the biggest question is, can we spot lodging prices spell negative? I deliberation the Fed volition enactment very, precise hard to make a brushed landing successful location prices.”

Schwab’s forecast has been for the Fed to footwear things disconnected by reducing its monthly plus purchases by $15 cardinal to $105 billion. That would mean cutting $10 cardinal from its existent $80 cardinal monthly gait of Treasury purchases and $5 cardinal from its $40 cardinal monthly gait of MBS.

“So far, we haven’t changed that,” Jones told MarketWatch.

While the Fed doesn’t acceptable semipermanent involvement rates, its wide buying of Treasurys aims to support a lid connected borrowing costs. Treasury yields besides pass the involvement complaint constituent of 30-year fixed-rate mortgages. So perhaps, scaling backmost some astatine erstwhile makes sense, Jones said.

Misremembering the 2013 taper

Fed Chair Powell said connected Wednesday that the cardinal bank’s “substantial further progress” modular for unemployment and ostentation successful peculiar hasn’t been met yet, portion stressing that he’d similar to spot much advancement successful the jobs marketplace earlier easing its monetary argumentation enactment for the economy.

Powell besides often has talked of lessons learned from the marketplace upheaval of 2013, the “taper tantrum” that rattled markets aft the cardinal slope began talking astir taking distant the punch bowl, arsenic the system healed from the Great Recession of 2008.

“What we request to remember,” Jablansky said, is that markets sold disconnected successful anticipation of tapering, not the existent propulsion backmost successful plus purchases. “Later successful the year, the play [former Fed Chair Ben] Bernanke was talking about, the Fed really continued to bargain assets, and the magnitude of accommodation it provided to the system really went up.”

Historically, the lone agelong wherever the Fed has actively withdrawn its enactment occurred betwixt 2017 and 2019, pursuing its controversial, archetypal foray into large-scale plus purchases to unfreeze recognition markets station 2008.

“It’s precise hard to gully a batch of conclusions from that existent abbreviated period,” Jablansky said. “For us, the decision is that 2013 whitethorn beryllium instructive, but the circumstances are truly different.”

The connection from Powell consistently has been astir preserving “maximum flexibility, but to spell precise slowly,” said George Catrambone, caput of Americas trading astatine plus manager DWS Group.

Catrambone thinks that whitethorn beryllium the close strategy, fixed the uncertain outlook connected inflation, evidenced by, the caller spike successful the outgo of living, but besides due to the fact that of however importantly galore of our lives person changed due to the fact that of the pandemic.

“We cognize that a utilized car won’t outgo much than a caller car forever,” Catrambone said. “Do I deliberation the lodging marketplace slows down? It could. But you truly request the supply, request imbalance to abate. That could instrumentality a while.”

Extreme wildfires, drought and different shocks of clime alteration have been tied to $30 cardinal successful spot losses successful the archetypal fractional of 2021, portion putting much patches of onshore and U.S. homes successful the way of danger. While these were little predominant lodging marketplace topics successful 2013, the pandemic besides changed the full conception of “what is safe” for galore families.

“Migratory patterns thin to beryllium sticky,” Catrambone said, of the formation retired of municipality centers to suburbia.

What’s more, the delta variant fueling a caller question of COVID-19 cases has led to stricter masking and vaccination policies, including astatine Alphabet Inc., GOOG, -0.97% Facebook Inc. FB, -0.56% and others, but besides delayed plans by galore large companies to instrumentality unit to offices buildings.

“This astir apt doesn’t assistance occupancy rates for commercialized existent estate, with much radical apt staying person to home,” Catrambone said, but it apt adds to the already precocious “psychological worth placed connected housing.”

After touching grounds highs, the S&P 500 scale SPX, -0.54%, Dow Jones Industrial Average DJIA, -0.42% and Nasdaq Composite Index COMP, -0.71% closed Friday and the week lower, but booked monthly gains.

On the U.S. economical information front, August kicks disconnected with manufacturing and operation spending data, followed by centrifugal vehicles sales, ADP employment and jobless claims, but the main absorption of the week volition beryllium the monthly nonfarm payrolls study connected Friday.

Read: Climate hazard is hitting location for authorities and section governments

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·