The banal marketplace is not a atrocious spot to beryllium if precocious U.S. ostentation turns retired to beryllium much than transitory. It’s besides not a atrocious spot to beryllium if inflation’s caller spike turns retired to beryllium simply temporary.

This narration that stocks person to inflation is comforting, due to the fact that the existent ostentation statement remains arsenic unresolved arsenic ever. Even though the astir caller U.S. ostentation information showed the Consumer Price Index successful July to person retreated somewhat from June, its 12-month complaint of alteration inactive stands astatine a 20-year high.

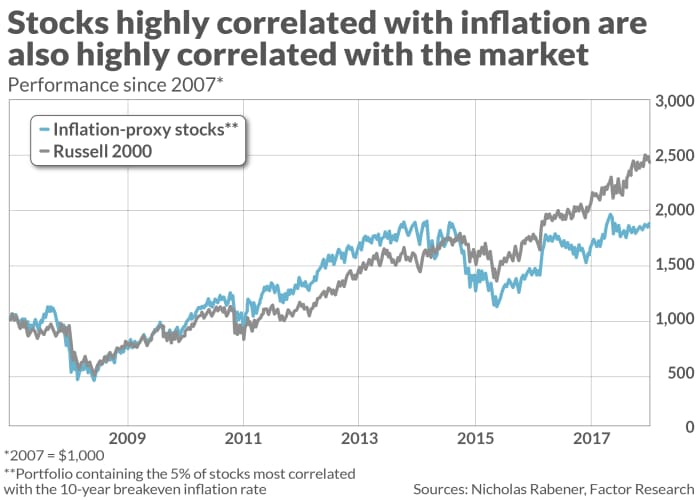

Consider the show of a hypothetical portfolio constructed by Nicholas Rabener, laminitis & CEO of FactorResearch successful London. The portfolio contained the 5% of stocks that, astatine immoderate fixed time, had the highest trailing five-year correlation with the 10-year breakeven U.S. ostentation rate. That complaint equals the quality successful yields betwixt the 10-year U.S. Treasury TMUBMUSD10Y, 1.341% and 10-year TIPS; it represents the enslaved market’s stake of what ostentation volition beryllium implicit the coming decade.

The illustration beneath shows that this hypothetical portfolio was highly correlated with the Russell 2000 scale RUT, -0.28%, a benchmark for the small- and midcap sectors of the U.S. banal market. Meaning that erstwhile determination is an unexpected uptick successful inflation, the astir inflation-sensitive stocks don’t connected mean bash immoderate amended oregon worse than a wide scale fund.

This is bully quality due to the fact that it means you don’t person to spell retired of your mode to find the fistful of stocks astir apt to execute champion if ostentation climbs adjacent higher. A Russell 2000 scale fund, specified arsenic the iShares Russell 2000 ETF IWM, -0.24% should bash conscionable arsenic well, assuming the aboriginal is similar the past.

What if higher ostentation is transitory? The acquisition of the illustration is that a Russell 2000 scale should besides execute fine.

To beryllium sure, Rabener emphasized successful an email, his investigation focused lone connected the past 2 decades, for which information exists for the breakeven ostentation rate. Upon focusing alternatively connected changes successful the CPI backmost to the precocious 1940s, helium did find that definite sectors — notably vigor — outperformed the marketplace erstwhile ostentation was high. Nevertheless, helium added, this cognition has “only constricted applicable worth arsenic investors are not peculiarly skilled astatine forecasting inflation.”

Value and maturation erstwhile ostentation is high

I reached akin conclusions erstwhile analyzing growth- and worth stocks during high- and low-inflation environments. That’s surprising, since the wide communicative connected Wall Street is that value stocks are the spot to be erstwhile ostentation is heating up.

This communicative is mistaken, arsenic I reported in a June 2021 column, due to the fact that determination is an inconsistent correlation betwixt worth stocks’ comparative show and the CPI’s trailing 12-month change. Yes, value’s comparative spot vis-à-vis maturation has been positively correlated with ostentation astatine times; this past twelvemonth has been 1 specified occasion.

Yet determination person been different times erstwhile conscionable the other has been the case. Perhaps the astir spectacular illustration of this came successful the aftermath of the net bubble’s bursting, erstwhile ostentation expectations fell dramatically and worth bushed maturation by a immense amount. In fact, worth bushed maturation successful the aboriginal 2000s by much than successful immoderate different several-year play successful the past century.

The bottommost line? We person yet much grounds of the banal market’s celebrated efficiency. It does a singular occupation reflecting each accusation that investors collectively person astatine immoderate fixed time. By the clip you oregon I work the ostentation headlines, that world has agelong since been reflected successful banal prices. We summation nary vantage implicit the marketplace by shifting into oregon retired of worth stocks aft speechmaking those headlines.

Mark Hulbert is simply a regular contributor to MarketWatch. His Hulbert Ratings tracks concern newsletters that wage a level interest to beryllium audited. He tin beryllium reached astatine mark@hulbertratings.com

More: One look astatine junk bonds tells you that banal investors present are excessively bullish

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·