Bitcoin and different cryptocurrencies tin beryllium among the astir volatile securities trading today.

A safer mode to put successful cryptos and blockchain-technology companies is done speech traded funds.

The Amplify Transformational Data Sharing ETF BLOK is, by far, the largest ETF focused connected cryptocurrencies and companies that usage oregon make blockchain technology. It has $1.3 cardinal successful assets and is actively managed. The second-biggest ETF successful the abstraction is the Siren Nasdaq NexGen Economy ETF BLCN, which is passively managed — it follows an scale — and has $291 cardinal successful assets. Both ETFs were established connected Jan. 17, 2018. There’s much astir each of them below.

Digital currencies — risks and rewards

Before digging into the blockchain ETFs, see the risks of bitcoin and different integer currencies beyond volatility. For example, if you clasp bitcoin successful a integer wallet, marque definite you don’t suffer your password. One capitalist lost entree to an relationship with 7,002 bitcoin successful 2012, according to Yahoo Finance. That equates to much than $327 million, based connected bitcoin’s BTCUSD settled terms of $46,777 connected Sept. 7.

There person besides been difficulties for radical who privation to commercialized cryptocurrencies connected days of precocious volatility and reports of hacked accounts and mediocre lawsuit service astatine Coinbase Global Inc. COIN, with customers incapable to retrieve mislaid bitcoin.

Coinbase has said only 0.01% of its customers person been affected by “account takeovers,” and analysts covering Coinbase’s banal are believers successful the company. Among 24 analysts polled by FactSet, 16 complaint the banal a “buy” oregon the equivalent. On Sept. 7, Needham expert John Todaro initiated his coverage of Coinbase with a “buy” standing and wrote that the institution “has done a bully occupation of offering caller assets and caller products successful a regulatory compliant manner, and is good connected its mode to becoming a one-stop store for crypto fiscal services.”

Blockchain ETFs

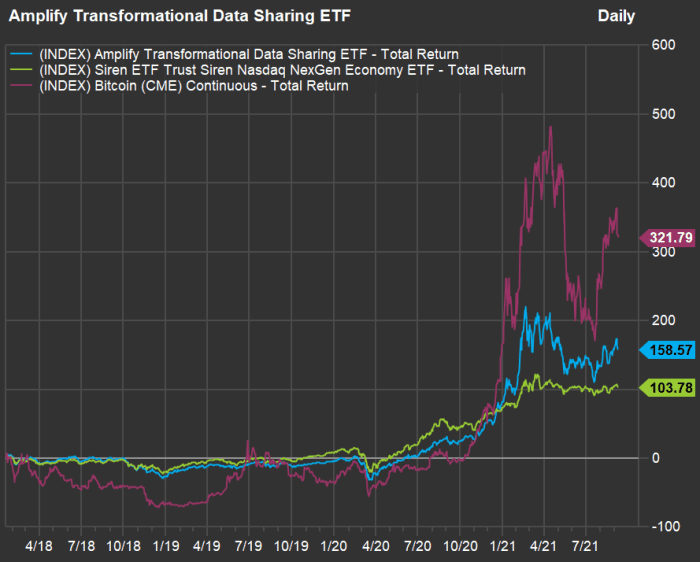

Here’s however the Amplify Transformational Data Sharing ETF BLOK and the Siren Nasdaq NexGen Economy ETF BLCN person performed since they were established, against the terms of bitcoin itself, successful U.S. dollars:

Bitcoin has had the champion show connected the chart, rising 322% since Jan. 17, 2018, with BLOK next, returning 159%, followed by BLCN, astatine 104%. Of course, we cannot foretell the absorption of bitcoin oregon different integer currencies, but the illustration shows however overmuch much volatile bitcoin has been than these ETFs.

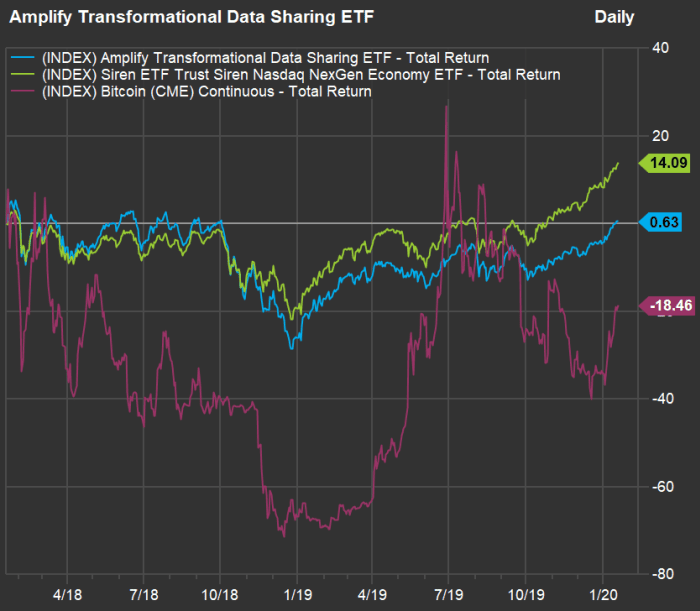

To further exemplify the volatility, cheque retired this illustration showing show of the ETFs’ archetypal 2 years:

Starting from Jan. 17, 2018, bitcoin was down arsenic overmuch arsenic 71% done Dec. 14, 2018. For the implicit two-year period, it was down 18%. Meanwhile, BLCN returned a affirmative 14% and BLOK was up 1%. The ETFs person been little volatile.

Once again, present are full instrumentality comparisons for the 2 ETFs, bitcoin and, for reference, the SPDR S&P 500 ETF Trust SPY and the Invesco QQQ Trust QQQ, which tracks the Nasdaq-100 Index NDX, for assorted periods:

| Fund oregon index | Total instrumentality – 2021 done Sept. 8 | Total instrumentality 1 year | Total instrumentality – 2 years | Total instrumentality – 3 years | Total instrumentality – Jan. 17, 2018, done Sept. 8, 2021 |

| Amplify Transformational Data Sharing ETF BLOK | 170% | 113% | 177% | 164% | 159% |

| Siren ETF Trust Siren Nasdaq NexGen Economy ETF BLCN | 88% | 44% | 106% | 113% | 104% |

| Bitcoin (CME) Continuous | 58% | 365% | 345% | 628% | 322% |

| SPDR S&P 500 ETF Trust | 44% | 37% | 57% | 66% | 72% |

| Invesco QQQ Trust | 81% | 42% | 101% | 115% | 136% |

| Source: FactSet | |||||

BLOK is rated 4 stars (out of five) by Morningstar, portion BLCN has a three-star rating. Since it was established, BLOK has much than doubled the instrumentality of SPY, and has outperformed QQQ handily.

Going backmost to the 2nd chart, above, which emphasizes bitcoin’s plunge successful 2018, you tin spot that BLCN fared amended than BLOK done that diminution and for that two-year period.

It whitethorn beryllium bully to see however apt you would person been to hold retired that hard play portion holding bitcoin. A broader concern successful blockchain technology, with vulnerability to cryptocurrencies, whitethorn acceptable your hazard tolerance better, portion inactive giving vulnerability to this technological phenomenon.

ETF portfolios

During an interview, Amplify CEO Christian Magoon said helium had decided to instrumentality an progressive attack with BLOK due to the fact that of added flexibility.

A passive attack to forming an scale of companies exposed to blockchain mightiness marque usage of algorithms for keyword searches successful institution filings for “blockchain” and related words, arsenic a mode to place companies making usage of the technology. But Magoon said BLOK’s subadviser, Toroso Investments, volition “take other steps to verify the existent blockchain-related activities of the companies we put in.”

That tin beryllium important successful a comparatively caller abstraction with plentifulness of buzzwords. You mightiness callback the communicative of Long Island Iced Tea Corp., which said successful December 2017 that it would alteration its absorption to investing successful blockchain technology, portion adopting the sanction Long Blockchain. That didn’t crook retired truthful well.

BLOK typically holds astir 45 stocks. Here are its 10 largest positions:

| Company | Share of portfolio | Market headdress ($mil, U.S.) | Total instrumentality – 2021 |

| Hut 8 Mining Corp. CA:HUT | 6.9% | $1,466 | 272% |

| MicroStrategy Inc. Class A MSTR | 5.5% | $4,971 | 64% |

| Marathon Digital Holdings Inc. MARA | 4.5% | $3,715 | 257% |

| PayPal Holdings Inc. PYPL | 4.5% | $335,154 | 22% |

| Square Inc. Class A SQ | 4.4% | $101,225 | 17.% |

| Hive Blockchain Technologies Ltd. CA:HIVE | 3.9% | $1,172 | 72% |

| Galaxy Digital Holdings Ltd. CA:GLXY | 3.9% | $2,037 | 145% |

| Nvidia Corp. NVDA | 3.8% | $556,688 | 71% |

| Coinbase Global Inc. Class A COIN | 3.6% | $38,980 | N/A |

| Bitfarms Ltd. CA:BITF | 3.6% | $993 | 201% |

| Sources: Amplify ETFs, FactSet | |||

Click connected the tickers for much astir each company. Here’s a caller usher to each the accusation disposable connected the MarketWatch punctuation pages, which tin commencement you disconnected connected your ain research.

It mightiness beryllium a astonishment to spot PayPal Holdings Inc. PYPL and Square Inc. SQSP successful the portfolio, but some supply services allowing customers to bargain and merchantability bitcoin.

Magoon emphasized that the diversification of BLOK’s portfolio lowered risk, but acknowledged that the ETF’s show is inactive intimately correlated with bitcoin.

Early this year, the Securities and Exchange Commission gave support for BLOK to clasp shares of the Grayscale Bitcoin Trust GBTC, which has a marketplace capitalization of $6.6 billion. It has been a fashionable mode for investors and traders to “play” bitcoin indirectly. But it has its ain risks, arsenic its stock terms astatine times tin emergence to a precise precocious premium implicit the trust’s nett plus worth (the worth of its investments astatine the extremity of the trading time divided by the fig of shares). This means GBTC has an other furniture of volatility connected apical of bitcoin’s price.

According to Magoon, GBTC has traded astatine a premium arsenic precocious arsenic 70% implicit NAV, though precocious it has traded beneath the NAV.

This other volatility led BLOK to wholly merchantability retired of its GBTC position, Magoon said. It present holds shares of Canadian speech traded funds that put successful bitcoin. Magoon says those thin to commercialized adjacent to NAV. An illustration of a Canadian bitcoin ETF held by artifact is the Purpose Bitcoin ETF CA:BTCC.

BCLN tends to person much holdings than BLOK — 69 stocks astatine the extremity of the 2nd quarter. It is besides little concentrated. BLOK’s 10 largest holdings marque up 45% of the portfolio. For BLCN, the 10 largest relationship for 21%.

Here are the 10 largest holdings of BCLN:

| Company | Share of portfolio | Market headdress ($mil, U.S.) | Total instrumentality – 2021 |

| Huobi Technology Holdings Ltd. HK:1611 | 2.7% | $509 | 108% |

| Coinbase Global Inc. Class A COIN | 2.4% | $38,980 | N/A |

| Accenture PLC Class A ACN | 2.1% | $215,809 | 32% |

| Square Inc. Class A SQ | 2.1% | $101,225 | 17% |

| Advanced Micro Devices Inc. AMD | 2.0% | $128,781 | 16% |

| Fujitsu Ltd. JP:6702 | 1.9% | $39,971 | 44% |

| Nvidia Corp. NVDA | 1.9% | $556,688 | 71% |

| Z Holdings Corp. JP:4689 | 1.9% | $50,552 | 18% |

| Marathon Digital Holdings Inc. MARA | 1.9% | $3,715 | N/A |

| Nasdaq Inc. NDAQ | 1.9% | $33,178 | 50% |

| Sources: Siren ETFs, FactSet | |||

Don’t miss: Wall Street sees arsenic overmuch arsenic 56% upside for its 20 favourite stocks

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·