A downturn successful planetary stocks appears to beryllium spilling implicit into the nascent crypto market, with a bout of play selling erupting into a mini-flash clang successful prices of bitcoin and different notable integer assets.

At past cheque Saturday day New York time, bitcoin BTCUSD, -21.43% was changing hands astatine $48,186.96 connected CoinDesk, down 12% implicit the past 24 hours, but the overnight descent, successful the aboriginal hours of Saturday morning, had been adjacent much harrowing. Bitcoin’s slump to astir $42,000 connected immoderate exchanges meant that it had tumbled astir 30% highest to trough connected a 24-hour basis.

NYDIG, a exertion and fiscal services steadfast dedicated to Bitcoin, said that the diminution was adjacent much terrible for immoderate offshore platforms specified arsenic Huobi, wherever bitcoin concisely touched a 24-hour nadir astatine $28,800.

That is simply a gut-wrenching fall, that whitethorn adjacent permission immoderate seasoned crypto bulls feeling a interaction queasy.

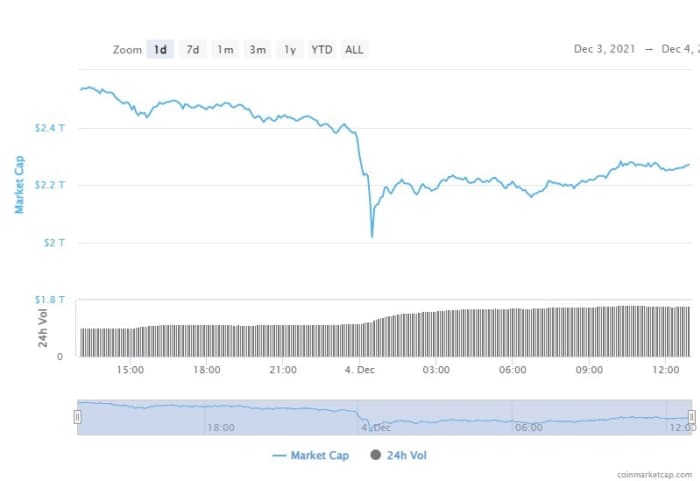

The driblet besides meant that the full marketplace worth of the crypto universe, arsenic tracked by CoinMarketCap.com, shed astir $400 cardinal to astir $2 trillion, earlier recovering to astir $2.2 trillion.

So what precipitated the drop? It isn’t 100% clear.

The analysts astatine CoinDesk blamed astatine slightest immoderate of the downturn connected trading successful crypto derivatives, amplified by increasing concerns astir the prospects for tighter fiscal conditions that is forcing a repricing of assets that are delicate to perchance rising borrowing costs.

“The diminution was apt successful portion technically-driven, exacerbated by the derivatives market, and not helped by the downside momentum down high-growth stocks connected Friday, to which bitcoin has been positively correlated,” wrote Katie Stockton of Fairlead Strategies, successful a Saturday greeting note.

NYDIG estimates that $1.1 cardinal of leveraged bitcoin positions and $2.5 cardinal of crypto leveraged positions (including bitcoin) person been liquidated successful the past 24 hours, representing the largest specified notional liquidation since Sept. 7.

Bitcoin ‘s values person been softening for weeks but declines for different risky assets person been accelerating with the Federal Reserve indicating it mightiness summation the gait astatine which it is withdrawing the marketplace enactment provided successful the past 18 months during the coronavirus pandemic arsenic it turns its attraction to restraining inflation. This alleged “tapering” of enslaved purchases has investors believing that interest-rates hikes are adjacent connected the cardinal bank’s docket successful 2022.

Some judge that bitcoin and different integer assets aren’t correlated with the prices of different assets, which has been heralded arsenic 1 of the much appealing features of bitcoin and its ilk. However, crypto has been trading much successful measurement with accepted stocks and bonds precocious partially due to the fact that of the prevailing debased interest-rate situation and if that changes past the values of a big of assets, besides factoring successful inflation, indispensable beryllium reassessed.

Put different way, the worth of an plus is its aboriginal income, discounted to the contiguous utilizing involvement rates, positive a “risk premium”—the other instrumentality you expect for owning thing riskier than a authorities bond. A rising involvement complaint diminishes the contiguous worth of that aboriginal income.

In accepted markets, that repricing has seen exertion shares underperform arsenic they are the astir delicate to shifts successful rates. The tech-laden Nasdaq Composite Index COMP, -1.92% stands 6% from its Nov. 19 peak, with declines gathering steam implicit the past week, amid fears astir the economical interaction of the coronavirus omicron variant and concerns astir the Fed’s monetary argumentation plans.

Meanwhile, the Dow Jones Industrial Average DJIA, -0.17%, is fractional mode toward a correction, and is disconnected much than 5% from its Nov. 8 grounds close, and the S&P 500 scale SPX, -0.84% is 3.5% from its all-time precocious adjacent enactment successful connected Nov. 18, portion the small-capitalization Russell 2000 scale fell into correction, commonly defined arsenic a autumn of astatine slightest 10% from a caller peak, connected Thursday.

On Twitter, Michael Novogratz, laminitis and Chief Executive of crypto steadfast Galaxy Digital, tweeted that the backdrop successful markets was a “perfect storm,” possibly referring to the tumble successful broader markets, omicron fears and hawkish comments from the Federal Reserve.

Fairlead’s Stockton says that if the downturn persists, aft bitcoin broke done an country of enactment astatine astir $53,000, it would suffice arsenic a much troubling method breakdown of the uptrend successful the asset’s price.

“ Momentum has weakened to the grade that determination is simply a pending play MACD ‘sell’ awesome that would beryllium solidified upon a confirmed breakdown tomorrow, she wrote, referring to the Moving Average Convergence/Divergence, utilized by method analysts arsenic a gauge of momentum successful an asset.

However, NYDIG suggested that they are seeing affirmative trends for bitcoin and crypto: “On our desk, we person seen two-way flows contiguous with 84% of the flows being buys connected our trading table excluding taxation nonaccomplishment harvesting trades,” the institution wrote successful a enactment connected Saturday.

In different crypto, Ether ETHUSD, -16.54% connected the Ethereum blockchain was trading down 6% but holding supra $4,000 astatine 4,050.85, astatine past cheque Saturday afternoon. It had been arsenic debased arsenic astir $3,500 overnight.

To beryllium sure, crypto is 1 of the much volatile assets and is inactive successful the signifier of gaining credibility arsenic a bona fide alternate asset.

Some crypto bulls, known for holding the concern semipermanent contempt its inclination for chaotic swings, were making airy of the Saturday slump specified arsenic this tweet from the Twitter relationship associated with Billy Markus, 1 of the founders of dogecoin DOGEUSD, -33.22%, which has go specified a fashionable meme plus that it has been duplicated by different tokens specified arsenic Shiba Inu SHIBUSD, .

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·