Just astir each capitalist is alert that a shortage of semiconductors and related equipment, including microprocessors and chips, are successful abbreviated proviso portion request is high. And yet the stocks of this captious radical commercialized comparatively debased to the broader banal market.

Below is simply a database of favourite semiconductor stocks among Wall Street analysts, based connected a heavy dive into the holdings of 5 speech traded funds focused connected the industry.

The spot shortage isn’t the full communicative — innovation and caller concern person lit fires nether immoderate of the best-known semiconductor companies. Shares of Nvidia Corp. NVDA, -0.91% were up 49% from the extremity of September done Nov. 8, portion Advanced Micro Devices Inc. AMD, -1.09% was up 46%.

These articles assistance explicate the large moves:

Industry appears cheaply valued

The PHLX Semiconductor Index SOX, -0.40% is considered the benchmark scale for spot makers and companies that marque instrumentality and systems utilized by them. It is tracked by the iShares Semiconductor ETF SOXX, -0.41%, which holds each 30 stocks successful the scale and is weighted by marketplace capitalization.

This means Nvidia is the apical holding, making up 9.7% of the portfolio, and the apical 5 investments, which besides see Broadcom Inc. AVGO, -0.23%, Intel Corp. INTC, -0.82%, Qualcomm Inc. QCOM, -0.01% and Texas Instruments Inc. TXN, -0.12%, relationship for 35.3% of the ETF’s assets. The sixth-ranked company, AMD, is 4.5% of the portfolio.

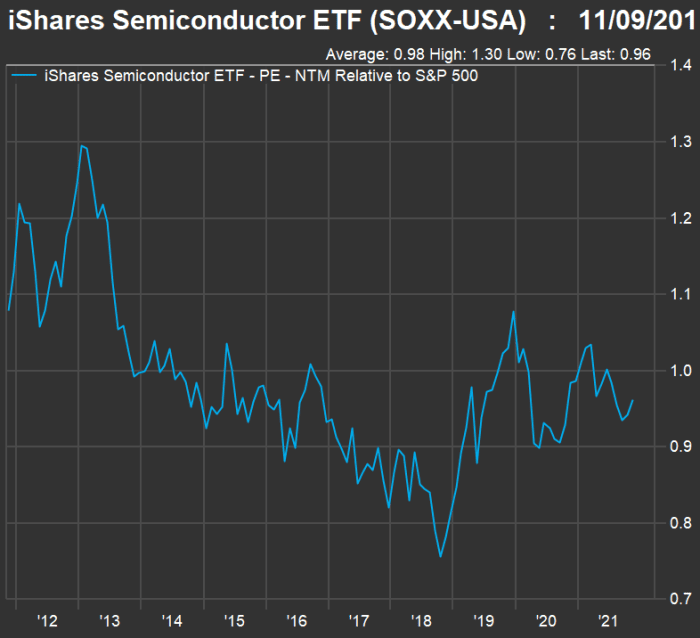

SOXX trades astatine a guardant price-to-earnings ratio of 20.9, based connected statement estimates among analysts polled by FactSet, portion the guardant P/E for the S&P 500 Index SPX, -0.45% is 21.7. It’s not antithetic for the semiconductors to commercialized astatine a discount. However, it is antithetic for determination to beryllium a wide shortage of the industry’s products.

Here’s however SOXX has traded comparative to the S&P 500 implicit the past 10 years:

Underlining the discount for the semiconductor radical is the anticipation that the radical volition summation its income and net overmuch much rapidly implicit the adjacent 2 years.

Here are expected compound yearly maturation rates (CAGR) for income and net per stock done 2023, based connected weighted statement estimates among analysts polled by FactSet:

| Estimated income per share | ||||

| 2021 | 2022 | 2023 | Expected two-year income CAGR | |

| iShares Semiconductor ETF | $77.72 | $85.64 | $94.61 | 10.3% |

| S&P 500 | $1,551.55 | $1,654.79 | $1,737.05 | 5.8% |

| 2021 | 2022 | 2023 | Expected two-year EPS CAGR | |

| iShares Semiconductor ETF | $22.17 | $23.97 | $35.59 | 26.7% |

| S&P 500 | $202.49 | $219.39 | $239.03 | 8.6% |

ETF heavy dive

To look beyond the SOXX 30, we reviewed 5 ETFs that travel antithetic approaches, to travel up with a broader archetypal database of stocks:

- SOXX is the largest, with $8.9 cardinal successful full assets, and is cap-weighted, arsenic described above. It holds the 30 largest U.S.-listed companies successful the industry, including American depositary receipts (ADRs) of overseas companies, specified arsenic Taiwan Semiconductor Manufacturing Co. TSM, +0.93%, which are capped astatine 10% of the portfolio. Its yearly expenses are 0.43% of assets nether management.

- The VanEck Semiconductor ETF SMH, -0.17% has $6.9 cardinal successful assets, with a cap-weighted portfolio of 25 stocks, selected though a scoring methodology that includes marketplace headdress and trading volume. It is adjacent much concentrated than SOXX, with its apical 5 holdings making up 44.4% of the portfolio, but its antithetic weighting strategy means Taiwan Semiconductor is the apical holding, astatine 14.5%. Its disbursal ratio is 0.35%.

- The SPDR S&P Semiconductor ETF XSD, -1.34% has $1.4 cardinal successful assets, with a modified adjacent weighting of 40 stocks that “tilts its portfolio distant from large, well-known companies and toward smaller maturation ones,” according to FactSet. Its disbursal ratio is 0.35%.

- The Invesco Dynamic Semiconductors ETF PSI, -0.30% besides leans toward smaller companies, with a modified equal-weighted $860 cardinal portfolio of 30 stocks, reconstituted quarterly. Its disbursal ratio is 0.56%.

- The First Trust Nasdaq Semiconductor ETF FTXL, -0.03% has $95 cardinal successful assets and holds 30 of the astir liquid semiconductor stocks listed successful the U.S., “weighted according to factors related to value, volatility and growth,” according to FactSet. Its largest holding is Synaptics Inc. SYNA, +0.33%, which makes up 8.3% of the portfolio. Its disbursal ratio is 0.60%.

Together, removing duplicates, the 5 ETFs clasp 65 stocks, with 62 covered by astatine slightest 5 analysts covered by FactSet.

Among the 62 companies, 25 person “buy” oregon equivalent ratings among astatine slightest 75% of the analysts. Only 10 of them are held by SOXX and lone 3 (including Nvidia) are held by each 5 ETFs. Here they are, ranked by the implied 12-month upside, based connected statement terms targets:

| Company | Share “buy” ratings | Closing terms – Nov. 8 | Consensus terms target | Implied 12-month upside potential | Forward P/E | Held by |

| Kulicke & Soffa Industries Inc. KLIC, -0.42% | 80% | $58.15 | $83.00 | 43% | 8.8 | PSI |

| MKS Instruments Inc. MKSI, +0.60% | 82% | $158.84 | $213.20 | 34% | 13.3 | SOXX, PSI |

| Cirrus Logic Inc. CRUS, -0.21% | 77% | $79.61 | $106.36 | 34% | 14.3 | XSD, FTXL |

| Micron Technology Inc. MU, +1.44% | 77% | $74.56 | $95.33 | 28% | 8.7 | SOXX, SMH, XSD, FTXL |

| Taiwan Semiconductor Manufacturing Co. ADR TSM, +0.93% | 90% | $120.91 | $153.01 | 27% | 26.0 | SOXX, SMH |

| Smart Global Holdings Inc. SGH, +0.05% | 100% | $58.24 | $72.00 | 24% | 9.1 | XSD |

| United Microelectronics Corp. ADR UMC, +0.40% | 81% | $11.18 | $13.82 | 24% | 12.4 | SOXX |

| Ultra Clean Holdings Inc. UCTT, +1.22% | 100% | $59.21 | $72.58 | 23% | 12.6 | PSI |

| Allegro MicroSystems Inc. ALGM, -2.20% | 100% | $32.68 | $40.00 | 22% | 39.4 | XSD, PSI |

| Onto Innovation Inc. ONTO, -0.82% | 100% | $90.50 | $105.00 | 16% | 20.1 | PSI |

| SiTime Corp. SITM, -10.42% | 100% | $291.34 | $328.20 | 13% | 79.4 | XSD |

| Axcelis Technologies Inc. ACLS, -0.57% | 100% | $61.85 | $68.50 | 11% | 17.5 | PSI |

| ASML Holding N.V. ADR ASML, -0.38% | 77% | $849.93 | $935.00 | 10% | 44.6 | SOXX, SMH |

| Diodes Inc. DIOD, +1.59% | 75% | $107.73 | $117.67 | 9% | 19.0 | XSD, PSI |

| Teradyne Inc. TER, +0.09% | 84% | $143.89 | $153.24 | 6% | 22.8 | SOXX, SMH, FTXL |

| Camtek Ltd. CAMT, +1.88% | 100% | $44.25 | $46.60 | 5% | 26.3 | PSI |

| Analog Devices Inc. ADI, +0.16% | 79% | $184.46 | $193.71 | 5% | 26.0 | SOXX, SMH, XSD, PSI, FTXL |

| Nova Ltd. NVMI, +0.71% | 100% | $128.77 | $135.00 | 5% | 30.3 | PSI |

| Marvell Technology Inc. MRVL, -0.38% | 80% | $73.00 | $75.12 | 3% | 43.2 | SOXX SMH, XSD, FTXL |

| Broadcom Inc. AVGO, -0.23% | 84% | $558.95 | $567.26 | 1% | 18.3 | SOXX, SMH, XSD, PSI, FTXL |

| Synopsys Inc. SNPS, +0.87% | 88% | $342.91 | $341.14 | -1% | 46.8 | SMH |

| Semtech Corp. SMTC, -0.57% | 91% | $90.52 | $88.30 | -2% | 32.4 | XSD |

| MaxLinear Inc. MXL, -1.27% | 75% | $68.32 | $66.60 | -3% | 21.4 | XSD, PSI |

| Impinj Inc. PI, -0.14% | 100% | $76.04 | $73.57 | -3% | 991.4 | XSD |

| Nvidia Corp. NVDA, -0.91% | 81% | $308.04 | $243.44 | -21% | 71.6 | SOXX, SMH, XSD, PSI, FTXL |

| Source: FactSet | ||||||

A surface tin lone beryllium the opening of your research, if you privation to clasp idiosyncratic stocks alternatively than marque wide investments utilizing ETFs oregon communal funds. Click connected the tickers for much astir each company. Click here for Tomi Kilgore’s elaborate usher to the wealthiness of accusation for escaped connected the MarketWatch punctuation page.

As you tin spot connected the table, immoderate of the stocks, contempt being truthful well-regarded, person gotten up of their one-year terms targets. Nvidia is simply a bully example. Why bash truthful galore analysts complaint it a buy, contempt believing the banal is overheated? Because they are looking astatine years beyond a 12-month target.

Don’t miss: 5 infrastructure stocks to bargain present that Biden’s measure has been passed, according to Jefferies

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·